Super User

SBA Forgiveness Instructions

SBA AND TREASURY RELEASE PPP LOAN FORGIVENESS APPLICATION AND INSTRUCTIONS

On May 15, 2020 (Release 20-41), the SBA and Department of the Treasury released the Paycheck Protection Program (PPP) Loan Forgiveness Application and Instructions under the CARES Act. A copy of the form may be found here. Here are the links for the CARES Act Section 1102 “Paycheck Protection Program” and Section 1106 “Loan Forgiveness".

SBA APPLICATION AND INSTRUCTIONS

The SBA press release issued the instructions for the Paycheck Protection Program (PPP) Loan Forgiveness and the Application for the Forgiveness.

The form and instructions inform borrowers how to apply for forgiveness of their PPP loans, consistent with the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). SBA will also soon issue regulations and guidance to further assist borrowers as they complete their applications, and to provide lenders with guidance on their responsibilities,

The form and instructions include several measures to reduce compliance burdens and simplify the process for borrowers, including:

|

|

|

|

|

|

|

|

|

SBA has stated that it will be issuing additional regulations and guidance to both borrowers and lenders in regard to the forgiveness process.

OUR ADVISORY SERVICES:

If you have any questions regarding the PPP loan program, please contact Mendoza, Silva & Company for SBA Audit Compliance Services with the PPP and SBA EILD Loans.

We can help you with;

- Bank Accounting & Grant Allocation (QuickBooks),

- SBA Section 1102, 1106 & 1110 Law Requirements,

- SBA Audit Record Keeping and Accounting Compliance for Grant Forgiveness,

- QuickBooks Accounting Monitoring,

- Payroll Accounting from Grant Allocation,

- Other Advisory & SBA Grant Audit Representation,

- IRS Representation if applicable

Call at 301-962-1700 for additional information.

Effectively Connected Income (ECI)

TAXATION OF FOREIGN REAL ESTATE INVESTORS IN THE U.S.

30% FLAT TAX ON RENTAL PROPERTY

The article was prepared for educational purposes only. The article is neither legal nor tax advice, nor is it to be construed as such. Each individual’s circumstances are different; you should seek legal and/or tax advice to address any specific question you may have.

RENTAL INCOME: FDAP

U.S. “Fixed, Determinable, Annual or Periodic” (FDAP) Income Tax for Nonresident Alien

Under U.S. Title 26, IRS section code § 871(a)(1), FDAP income includes rental real estate income received on rental property as passive income. FDAP rental income is taxed at a flat tax rate of 30% of the “Gross Rental Income” for the calendar year. The tax applies to foreign persons earning rental income in the U.S. or the lower tax rates under a tax treaty between the investor’s country of residence and the U.S.

In a tax examination, the IRS determines taxable income (FDAP income) as the total rental income collected during the taxable year. All expenses are foregone and non-deductible. No deductions for management fees, property taxes, mortgage interest expenses, depreciation, repairs and maintenance, and other rental costs on the IRS Form Schedule-E “Supplemental Income and Loss” are allowed. FDAP disallows all rental deductions unless the Effectively Connected Income (ECI) is filed.

Example: Mathis and Carol Dubois are Argentinian citizens living in Argentina, and in December 2016, they purchased a rental property at Pike & Rose in North Bethesda. In 2017, the couple contracted a local rental management company to rent out a two-bedroom condo with two baths and a living space of 1,291 square feet for $3,000.00 monthly, a bargain in the area.

The property was rented in 2017 for the entire year. The total annual rental gross income was $36,000.00, and it had $37,257 in qualified rental expenses. The rental LOSS was ($1,257), and the couple’s nontaxable cash-flow for the year was $10,970.00. The benefit of rental property is the deprecation deduction allowed for rental real estate. For the Dubois, the rental property depreciation for 2017 was $12,197.00, and the same amount is to be deducted for the next 27.5 years. During the period, the Dubois nontaxable cash-flow is estimated to be $301,675.00. Not a bad deal for investing in the U.S.

Without knowing about the tax implications of FDAP, the couple engages a local tax preparer to help file the 2017 Form 1040NR “U.S. Nonresident Alien Income Tax Return” and reports the ($1,257) loss on their Schedule-E.

The Dubois are excited with the zero tax liability for the next 27.5 years and consider buying a second investment property in October 2019. In May 2019, the couple calls their friend Rachel, a Maryland licensed real estate agent, about making an investment in a new property. Rachel was involved in the previous acquisition, and the Dubois regard her as the couple's real estate guru.

Rachel is excited about getting a call from the Dubois and equally enthusiastic that her international investor ledger is growing. The plan is set for October 2019, and Rachel puts on her real estate guru hat and searches properties for the Dubois to evaluate. The Dubois’ investment goals are as follows; two bedrooms, two baths, 1,300 square feet, Fair Market Value of $700,000, with a $140,000 down payment plus closing cost.

In September 2019, The IRS audited the Dubois’ 2017 tax return and disallowed the $37,257 rental expenses under the FDAP regulations. The IRS assesses a tax liability of $10,800.00 plus a 75% civil fraud penalty (Section 6663(a)), plus failure to deposit penalty, plus failure to pay penalty and interest. Total tax assessment for 2017 is $20,000+. Further, $10,800 is the yearly estimated tax for each year the property is rented. According to this annual number, the couple will pay an estimated $297,000 in taxes for the next 27.5 years under FDAP ($10,800.00 x 27.5 years).

The new investment property deal is off the table after the bad news from the IRS. Rachel is fired on the spot, and she is blamed for not providing them with tax advice. Rachel is not responsible for the tax problems, but in the real world, real estate agents are to blame for all matters. Rachel loses the Dubois and the opportunity to grow her international ledger.

All this could have been prevented if Rachel and the Dubois knew about the Effectively Connected Income (ECI) tax incentive, which allows Nonresident Alien Investors to file an IRS tax election in order to be taxed at the “NET BASIS” or the ($1,257) loss in the Dubois’ case. The tax election could have allowed the zero tax result for Dubois’ just the same as US Citizens and resident aliens.

SOLUTIONS:

A foreign investor will need to contact a real estate tax accountant and amend three years of tax returns before an IRS examination. The “key” is before the IRS examination. The investor will need to amend 2018, 2017, and 2016 Form 1040NR and include the ECI election with each amended tax return. Under IRS 6501 and IRS Internal Revenue Manual IRM-25.6.1.6.4 “Statute of Limitations on Assessment,” the IRS has three years to audit and access additional taxes from the due date of the return, or three years after the date the return was filed, whichever is later.

Real estate agents and management companies may have clients at risk for the FDAP regulations and IRS examination. Inform your clients of the risk of FDAP and give us a call for assistance.

EFFECTIVELY CONNECTED INCOME

RENTAL INCOME: ECI

Under U.S Title 26, IRS 871 (d) “net basis” election, the IRS code allows an Effectively Connected Income (ECI) election “to treat real property income as income connected with United States business. In general, a nonresident alien individual who during the taxable year derives any income - from real property held for the production of income and located in the United States” can deduct qualified rental expenses.

The ECI regulations are good news for foreign investors and real estate agents. In the Dubois’ case, the election would have allowed $37,257 in real estate expenses and zeroed out their tax liability. Rachel would have kept the Dubois as clients and grown her international investor ledger.

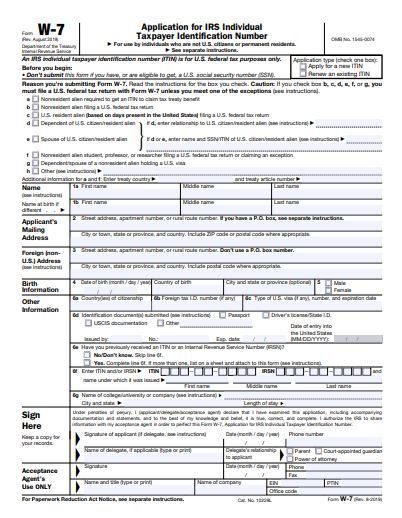

To qualify for ECI benefits, the investor must;

- Obtain an ITIN or EIN number from the IRS,

- Under IRS 871(d), treat the rental income as EIC,

- Make annual EIC elections for each year the property is rented on Form 1040NR, and

- Provide the correct W-8 form to the management company.

The Dubois represents the typical foreign investor we represent in our Bethesda office nationwide. As a tax firm, we can provide the following services to foreign investors.

Our services include:

- IRS ITIN or EIN investors numbers,

- File annual “Effectively Connected Income” elections with the IRS,

- Prepare and provide management company an annual signed Form W-8ECI,

- File IRS Form 1040NR annually for investors,

- Report Income and Expenses on Schedule E,

- If applicable, represent investors in the IRS examination, audits and tax resolution matters.

You need the right tax team working with you. Consider us, Mendoza, Silva & Company for all of your tax services. Consult with an enrolled agent, CPA, or Tax Attorney to assist with foreign investors buying rental property in the United States.

Call us for a complimentary evaluation at 301-962-1700. Mendoza, Silva & Company is located in Bethesda, Maryland, and Miami, Florida.

Do You Know When Your ITIN Expired?

The IRS issues Individual Taxpayer Identification Numbers (ITIN) to individuals who are not eligible to obtain a Social Security Number.

Under the Protecting Americans from Tax Hikes (PATH) Act, IRS had established in 2016 tax year the ITIN’s Renewal Program. The rule is simple if an ITIN holder had not filed taxes for the tax years 2016, 2017, or 2018, there ITIN numbers will expire on December 31, 2019. Also, for ITIN’s with middle digits of 83, 84, 85, 86, or 87 (e.g., 9XX-83-XXXX), they will expire at the end of 2019 as well.

Expired ITIN numbers (Middle two digits);

| 2016 | 78 & 79 |

| 2017 | 70, 71, 72 & 80 |

| 2018 | 73, 74, 75, 76, 77, 81 & 82 |

To Expired In 2019 (Middle two digits);

| 2019 | 83, 84, 85, 86 & 87 |

The IRS is sending the Notice “CP-48” to all ITIN holders who must renew their number before December 31, 2019. However, the ITIN holder is not required to wait until receiving this notice to begin the process. If you have an ITIN with middle digits of 83, 84, 85, 86 or 87, you can start the process anytime from now until the end of the year. It is recommended to comply with the renewal as soon as possible to avoid delay from the IRS.

The ITIN renew process is simple, and a tax return is not required to be filed with the request. The taxpayer will need to submit a new Form W7 and supporting documentation to the IRS. However, the IRS does not accept copies of taxpayer supporting documentation unless it is issued by an IRS Agent, Certifying Acceptance Agents (CAA’s).

The Mendoza, Silva & Company team is certified to request your renewal and authenticate your supporting documentation for you. Therefore, you are not at risk of losing your original documents or waiting for weeks until it is returned to you. In our office, we will certify copies of your documents and return your originals to you at the time of your appointment. It is faster and easier!

Avoid common errors now and prevent delays next year

Federal tax returns that are submitted in 2019 with an expired ITIN will be processed. However, certain tax credits and any exemptions will be disallowed. Taxpayers will receive a notice in the mail advising them of the change to their tax return and their need to renew their ITIN. Once the ITIN is renewed, applicable credits and exemptions will be restored and any refunds will be issued.

Additionally, several common errors can slow down and hold some ITIN renewal applications. These mistakes generally center on missing information or insufficient supporting documentation, such as name changes. The IRS urges any applicant to check over their form carefully before sending it to the IRS.

As a reminder, the IRS no longer accepts passports that do not have a date of entry into the U.S. as a stand-alone identification document for dependents from a country other than Canada or Mexico, or dependents of U.S. military personnel overseas. The dependent’s passport must have a date of entry stamp, otherwise the following additional documents to prove U.S. residency are required:

- U.S. medical records for dependents under age 6,

- U.S. school records for dependents under age 18, and

- U.S. school records (if a student), rental statements, bank statements or utility bills listing the applicant’s name and U.S. address, if over age 18.

Link to Acceptance Agents - Maryland

2019 Tax Organizer - Maximize Your Deductions

Download a Tax Organizer Form-Fill-In PDFs for 2019 tax season

These Tax Organizers are designed to help you gather the tax information needed to prepare your personal income or business tax return for 2018. A Tax Organizer is a great tool to help you reduce your taxes or increase your tax refund.

Individuals

2018 Basic Organizer (4 Pages) –This organizer is suitable for clients that are not itemizing their deductions and DO NOT have rental property or self-employment expenses.

2018 Full Organizer (8 Pages) – This organizer includes the information included in the basic organizer, plus entries for itemized deductions, rental properties, and self-employment expenses.

Business

2018 Basic Organizer (4 Pages) – This organizer is suitable for clients with self-employment income, partnership income, and corporation income. (Schedule C, 1065 & 1120s)

We can help you file your tax returns. Schedule Online.

The following are examples of supporting documentation:

- Forms W-2 for wages, salaries, tips, and gambling winnings.

- All Forms 1099 for interest, dividends, retirement, miscellaneous income, social security, state or local refunds, etc.

- Form 1099B Brokerage statements showing investment transactions for stocks, bonds, options, etc.

- Schedule K-1 from partnerships, S-corporations, estates, and trusts.

- Statements supporting educational expenses, deductions or distributions, including any Forms 1098-T, 1098-E, or 1099-Q.

- All Forms 1095-A, 1095-B, and/or 1095-C related to health care coverage for the Premium Tax Credit.

- Statements supporting deductions for mortgage interest, taxes, and charitable contributions, including any Form 1098-Mort.

- Copies of closing statements regarding the sale or purchase of real property.

- Legal papers for adoption, divorce, or separation involving custody of your dependent children.

- Any tax notices sent to you by the IRS or other taxing authority.

- A copy of your income tax return from last year, if not prepared by Mendoza, Silva & Company.

Call us today at 301-962-1700.

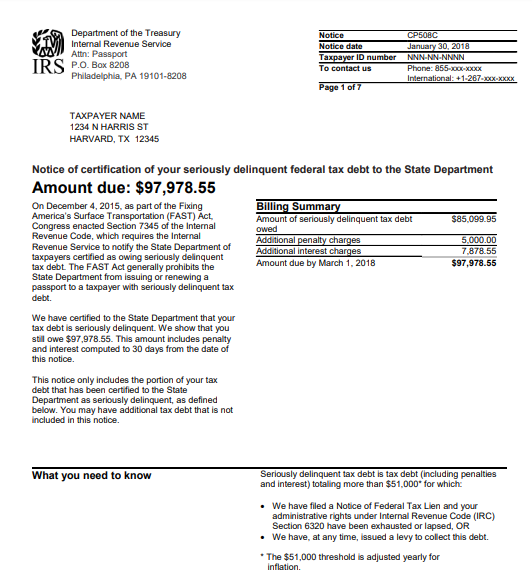

Passport Alert – IRS Tax Debts May Revoke Your Passport

Owing more than $51,000.00 of taxes can stop your travel plans.

Beginning in 2018, The IRS started mailing to Taxpayers owing more than $51,000.00 a notice called "CP508C - Notice of Certification of your Seriously Delinquent federal tax debt to the State Department".

If you owe taxes over $51,000, the IRS may inform the State Department which can then revoke your passport. And you might not even know until you get to the airport.

"On December 4, 2015, as part of the Fixing America’s Surface Transportation (FAST) Act, Congress enacted Section IRC §7345 of the Internal Revenue Code, which requires the Internal Revenue Service to notify the State Department of taxpayers owing more than $51,000.00 and certifying the Taxpayer as “Seriously Delinquent. The FAST Act generally prohibits the State Department from issuing or renewing a passport to a Taxpayer with seriously delinquent tax debt. (per IRS)"

The IRS has the following power if you don’t act soon;

- Filed a Notice of Federal Tax Lien,

- Issued a levy to collect the debt to your employer or from your customers,

- If you apply for a passport or passport renewal, the State Department will deny your application,

- If you currently have a valid passport, the State Department may revoke your passport or limit your ability to travel outside the United States.

It is estimated that about 270,000 Taxpayers are about to receive Notice CP508C in 2019.

Step 1: What to Do?

- Give us a call,

- Request the IRS to provide the detail of accounting for the years and the balances under question. We will call on your behalf and request IRS “Account Transcripts.”

- Evaluate the Account Transcripts for missing payments and locate the canceled check(s) for account adjustments.

- Verify if the amount owed is correct.

Step 2: Propose a Viable Collection Alternative

- Stablish Installment agreement (IA). The installment agreement must be accepted with the IRS prior the passport revocation can be reversed.

- Offer in Compromise (OIC). Same as IA, it must be accepted.

- Request for an Innocent Spouse Relief. While the request is pending, reversal is available. IRC §6015(e)(1)(B) prohibits enforcement while the application is pending. If the debt is related to your spouse income or business and you did not participate in the business activity, Innocent Spouse Relief can be a good avenue for passport revocation reversal. The key is that the request does not need to be accepted by the service. It only needs to be pending.

Key Facts

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

- Resolve any erroneous assessment issues (Incorrect tax debts or identity theft matters)

- Make full payment of their debt,

- Enter into a satisfactory payment arrangement – IRM 5.1.12.27.7(6).

Reversal Certification under IRC §7345(c)

You have established a collection alternative with the IRS and accepted. The IRS must give notice to the State Department reversing the certification if:

- Certification is found to be erroneous,

- Debt is legally unenforceable,

- Debt is fully satisfied,

- Debt is no longer “seriously delinquent” per §7345(b),

- Installment Agreement is entered into,

- Offer in Compromise is accepted,

- Justice Department enters into a settlement agreement,

- Innocent Spouse Relief is requested.

Once the (IA) and (OIC) are accepted or Innocent Spouse Relief request is pending, the IRS will mail the “Reversal” notice to taxpayer CP508R and to the State Department.

If you have questions or concerns about the passport revocation, please call Mendoza, Silva & Company today!

We are here to help.

2018 Child & Dependent Tax Credits

Increased to $2,000 in 2018

The child tax credit increases in 2018 to $2,000 (up from $1,000) with up to $1,400 being refundable. The earned income threshold is reduced to $2,500 (down from $3,000 in 2017) allowing more taxpayers to qualify for the credit. A child has to be under the age of 17 and have a valid Social Security number issued before the return due date to qualify for the credit.

In addition, a non-refundable tax credit of $500 is available for each non-child dependent that does not qualify for the child tax credit. The AGI thresholds at which the credit begins to phase out are substantially increased: to $400,000 for married filing jointly and $200,000 for all other taxpayers.

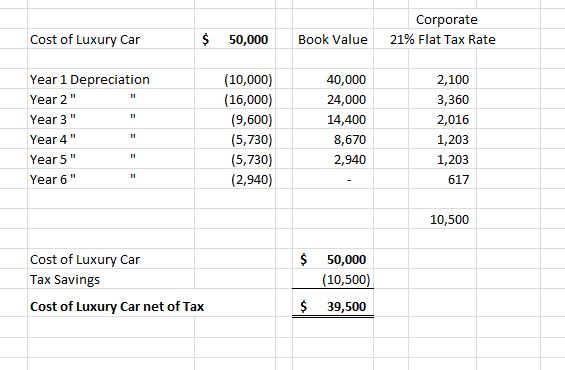

2018 Luxury Auto Limits for Business Auto Deductions

Luxury Auto Limits for Business Autos

The 2018 tax bill increased the luxury auto depreciation deduction limits for the 1st, 2nd, 3rd and subsequent years with the year first increased to $10,000 and the second year to $16,000.

What is a Luxury Auto?

The IRS definition of a "luxury vehicle," is a four-wheeled vehicle regardless the cost of the vehicle, used mostly on public roads, and has an unloaded gross weight of no more than 6,000 pounds.

What is the Corporate Tax Savings?

The most dramatic changes made by the 2018 Tax bill is on the corporate rate. For starters, the bill lowers the corporate tax rate to a flat 21% on all profits from 35% through January 1, 2026. This is not only a massive tax-cut, but is a major simplification as compared to the 2017 corporate tax rates. The flat 21% corporate tax change can save an entity up to $10,500.00 in corporate taxes for an auto costing $50,000.

Here is an example of a Luxury Auto costing $50,000 and put in services on January 1, 2018. Notice, the tax saving is $10,500 over five and half years and resulting in the actual cost to $39,500 net of corporate taxes.

If you have questions about your Luxury Auto tax saving for a corporation, please give this office a call at 301-962-1700.

H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for the fiscal year 2018.

How to Save for a Child's College Education

Article Highlights:

- Planning for a Child’s College Education

- Tax-Favored Plans

- Tax-Free Earnings

- Coverdell Accounts

- Qualified Tuition Plans

- Have Others Contribute

- Gift Tax Issues

A frequently asked question is, “How might I save for a child’s college education?” The answer depends on how much education is expected to cost and how much time is left until the child heads off to college or university.

The amount of funds that will be required will depend upon whether your child will be attending a local college, attending a local college and then transferring to a university, or going straight to the university. If attending college locally, you generally only need to be concerned about tuition, and the child can live at home, whereas attending a university unless it is local, will add the cost of housing and food on top of substantially higher university tuition. Another factor is whether the student will leave school after obtaining a bachelor’s degree or will be doing graduate studies for an advanced degree.

When the time comes, your child may qualify for a scholarship or grant, but you can’t depend on that when working out a college savings plan.

The federal tax code has two beneficial savings plans that can be used. In both plans, there is no tax benefit to making any contributions. The benefit is that growth due to appreciation in investments if any, and earnings (dividends and interest) are tax-free when withdrawn for qualified education expenses. Thus, the sooner the plan is started, the better because it will have more years to grow in value.

More tax benefit is gained by front-loading the contributions and thus having a larger amount on which to compound the growth and earnings. You should also be aware that anyone, not just you, can make a contribution to the child’s college savings plans. So if your child has any well-heeled grandparents, other relatives or friends who would like to help, they can also contribute.

The two savings plans currently available for college savings are the Coverdell Education Savings Account and the Qualified Tuition Plan, most commonly referred to as a Sec. 529 Plan (529 denotes the section of the tax law code that governs it).

Coverdell Education Savings Account – This plan only allows up to $2,000 in contributions per year, and although it allows withdraws for kindergarten education and above, the contribution limitations generally rule it out as a practical method for college savings.

Sec 529 Plan – This approach is likely your best option. State-run Sec. 529 plan benefits are limited to postsecondary education, but they allow significantly larger amounts to be contributed; multiple people can each contribute up to the gift tax limit each year without being subjected to gift tax reporting. This limit is $15,000 for 2018. A special rule allows contributors to make up to five years of contributions in advance (for a total of $75,000 in 2018).

Sec. 529 plans allow taxpayers to put away larger amounts of money, limited only by the contributor’s gift tax concerns and the contribution limits of the intended plan. There are no limits on the number of contributors, and there are no income or age limitations. The maximum amount that can be contributed per beneficiary (the intended student) is based on the projected cost of college education and will vary between the states’ plans. Some states base their maximum on an in-state four-year education, but others use the cost of the most expensive schools in the U.S., including graduate studies. Most have limits in excess of $200,000, with some topping $370,000. Generally, additional contributions cannot be made once an account reaches that level, but that doesn’t prevent the account from continuing to grow.

When the time comes for college, the distributions will be part earnings/growth in value and part contributions. The contribution part is never taxable, and the earnings part is tax-free if used to pay for qualified college expenses. In addition, the portion of the distribution that represents the return on the contributions and is used for qualified education expenses qualifies for the American Opportunity Tax Credit, which can be as much as $2,500, provided your income level does not phase it out.

For additional details or assistance in planning for a child’s higher education, please give this office a call.

Using Online Agents to Rent Your Home Short Term?

You May Be Surprised at the Tax Ramifications

Article Highlights:

- Schedule C vs. Schedule E

- Rentals of Less Than15 Days

- Rentals of 7 Days or Less

- Rentals of 8 to 30 Days

- An exception to the 30-Day Rule

If you are among the many taxpayers renting your first or second home using rental agents or online rental services that match property owners with prospective renters, such as Airbnb, VRBO and HomeAway, then you should know the IRS has special rules related to short-term rentals.

When property is rented for short periods, special (and sometimes complex) taxation rules come into play, which can make the rents excludable from taxation; other situations may force the rental income and expenses to be reported on Schedule C (as opposed to Schedule E). If you have been renting your home or second home for short periods of time, here is a synopsis of the rules governing short-term rentals so you can prepare yourself for the upcoming tax season.

- Rented for Fewer Than 15 Days During the Year: If you rent your property for fewer than 15 days during the tax year, the rental income is not reportable, and the expenses associated with that rental are not deductible. However, interest and property taxes are still deductible as itemized deductions on your Schedule A.

- Rented for an Average of 7 Days or Less: Under normal circumstances, rentals are treated as passive activities, which are reported on a Schedule E, and net profit from the rental activity is not subject to self-employment tax. But the special rules treat short-term rentals averaging 7 days or less as a trade or business similar to that of a hotel or motel, with the income and expenses reported on Schedule C, and the profits are subject to both income tax and self-employment tax.

- Rented for an Average of 8 to 30 Days: Even rentals for longer than 7 days are treated as a trade or business when substantial personal services are provided to the short-term tenant. Substantial services are those that are primarily for your tenant's convenience, such as regular cleaning, changing linen, or maid service. Substantial services do not include the furnishing of heat and light, the cleaning of public areas, trash collection, and such.

When extraordinary services are provided, the rental is treated as a trade or business and reported on Schedule C regardless of the average rental period. However, it would be extremely rare for this to apply to short-term rentals of your home or second home.

- Exception to the Significant Services Rule – If the personal services provided are similar to those that generally are provided in connection with long-term rentals of high-grade commercial or residential real property (such as the cleaning of public areas and trash collection), and if the rental also includes maid and linen services at a cost of less than 10% of the rental fee, then the personal services are neither significant nor extraordinary for the purposes of the 30-day rule.

A loss from this type of activity, even when reported on your Schedule C as a trade or business, is still treated as a passive activity loss and can only be deducted against passive income. The $25,000 loss allowance that applies to some Schedule E rentals is not available for rental activities reportable on Schedule C.

It is important that you keep a record of not only the rental income from each tenant but also the duration of each rental, so the average rental term for the year can be determined. If you have questions about your rental activities, please give this office a call.

Seminario Contratos con el Gobierno - Parte 2

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.