Medical expenses are a financial burden that many of us face any given year. In fact, researchers found that between 2009 and 2020, medical expenses became the number one source of debt owed to collection agencies in the U.S. To help ease the burden, the IRS allows you to deduct most unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI) when filing a Schedule A. If your out-of-pocket medical expenses have consumed more than 7.5% of your AGI, pay attention! The following examples can help you get a clearer picture of what medical expenses you can deduct this tax year.

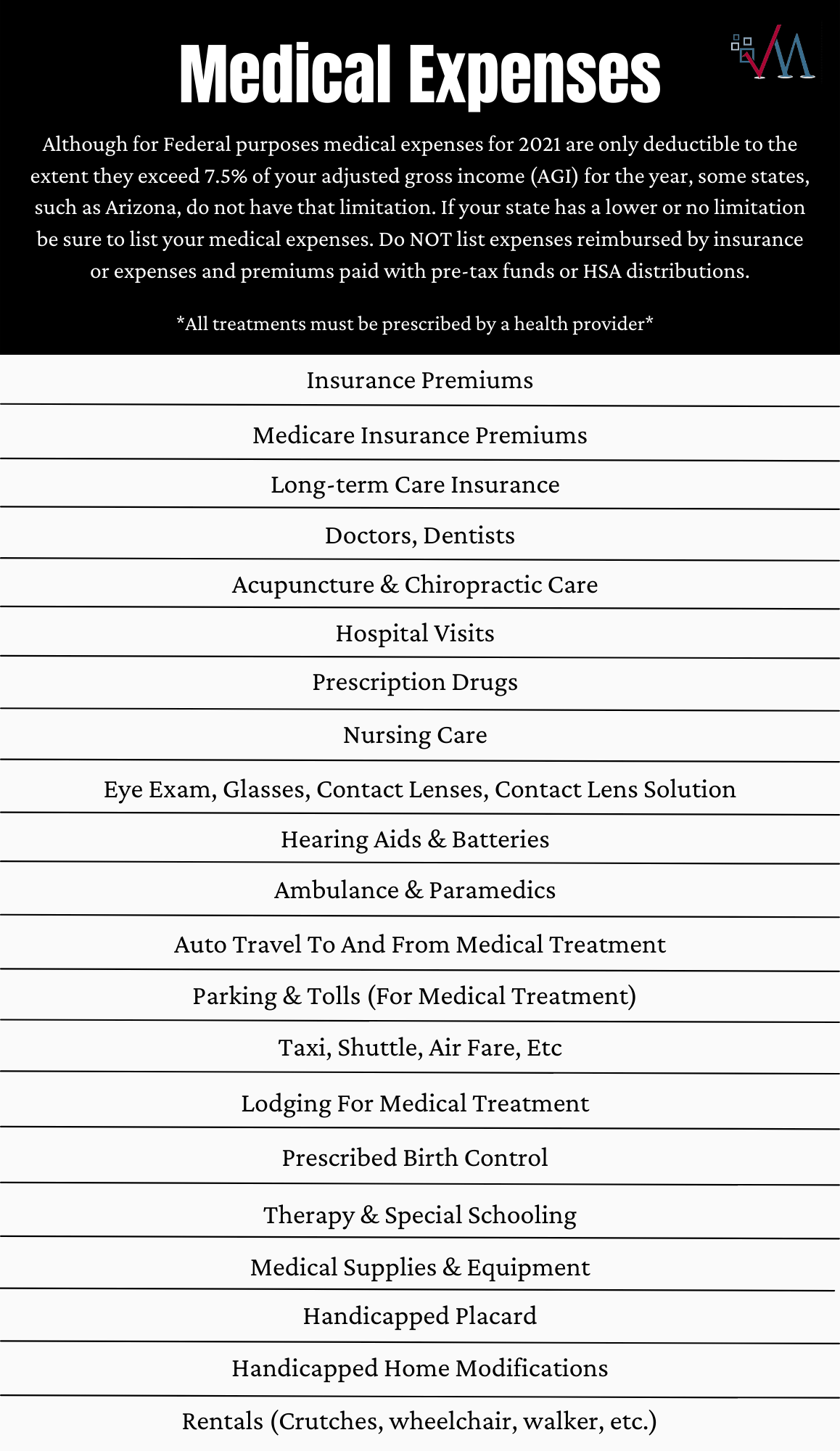

According to the IRS, “medical expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.” This includes fees for doctors, surgeons, dentists, psychologists, and others, in-patient hospital care or residential nursing home care, payments for insulin, false teeth, reading or prescription glasses, hearing aids, and even insurance premiums. The full list of covered medical expenses can be found in the attached image to this post. Although medical expense deductions cover a broad spectrum of medical services, it still has its limitations.

What is, and is not deductible, can be hard to determine. For items that are not covered in this article, refer to this free IRS questionnaire that can help you figure out what you can deduct: https://www.irs.gov/help/ita/can-i-deduct-my-medical-and-dental-expenses For example, the IRS only allows medical deductions if the expenses were paid in the same year as the deduction. You must also reduce your total deductible expenses for the year by any reimbursement of deductible expenses, including medical insurance or if it is paid on behalf of your doctor, hospital, or other medical provider. The agency also notes that you may not deduct for funeral or burial expenses, nonprescription medicines, toiletries, cosmetics, trips or programs for your mental health, or most cosmetic surgeries. Although smoking-cessation programs can potentially be deductible if prescribed by your medical provider, nicotine gum and nicotine patches are not deductible since it is an over the counter treatment, and not medically prescribed by a physician. Generally, if a treatment is prescribed to you by your health provider, it is deductible.

Of course, we are here to help. If you have any additional questions regarding medical deductions, please feel free to leave us a comment on this post or send us an email at This email address is being protected from spambots. You need JavaScript enabled to view it..

Planning on going to GoodWill or Salvation Army to drop off your donations? On our itinerary next week, we will be talking about charitable contributions. This is a popular deduction that can help most of you save this tax season. You don’t want to miss out.