Blog - Tax Related

Items filtered by date: October 2019

Do You Know When Your ITIN Expired?

The IRS issues Individual Taxpayer Identification Numbers (ITIN) to individuals who are not eligible to obtain a Social Security Number.

Under the Protecting Americans from Tax Hikes (PATH) Act, IRS had established in 2016 tax year the ITIN’s Renewal Program. The rule is simple if an ITIN holder had not filed taxes for the tax years 2016, 2017, or 2018, there ITIN numbers will expire on December 31, 2019. Also, for ITIN’s with middle digits of 83, 84, 85, 86, or 87 (e.g., 9XX-83-XXXX), they will expire at the end of 2019 as well.

Expired ITIN numbers (Middle two digits);

| 2016 | 78 & 79 |

| 2017 | 70, 71, 72 & 80 |

| 2018 | 73, 74, 75, 76, 77, 81 & 82 |

To Expired In 2019 (Middle two digits);

| 2019 | 83, 84, 85, 86 & 87 |

The IRS is sending the Notice “CP-48” to all ITIN holders who must renew their number before December 31, 2019. However, the ITIN holder is not required to wait until receiving this notice to begin the process. If you have an ITIN with middle digits of 83, 84, 85, 86 or 87, you can start the process anytime from now until the end of the year. It is recommended to comply with the renewal as soon as possible to avoid delay from the IRS.

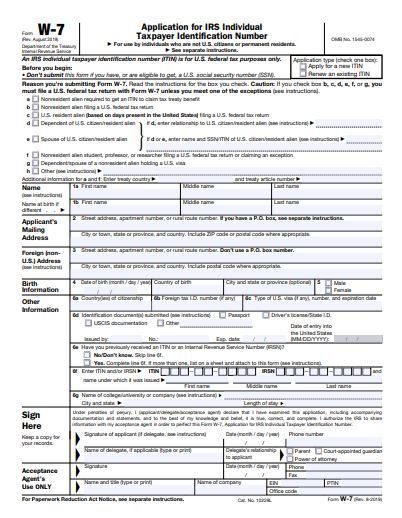

The ITIN renew process is simple, and a tax return is not required to be filed with the request. The taxpayer will need to submit a new Form W7 and supporting documentation to the IRS. However, the IRS does not accept copies of taxpayer supporting documentation unless it is issued by an IRS Agent, Certifying Acceptance Agents (CAA’s).

The Mendoza, Silva & Company team is certified to request your renewal and authenticate your supporting documentation for you. Therefore, you are not at risk of losing your original documents or waiting for weeks until it is returned to you. In our office, we will certify copies of your documents and return your originals to you at the time of your appointment. It is faster and easier!

Avoid common errors now and prevent delays next year

Federal tax returns that are submitted in 2019 with an expired ITIN will be processed. However, certain tax credits and any exemptions will be disallowed. Taxpayers will receive a notice in the mail advising them of the change to their tax return and their need to renew their ITIN. Once the ITIN is renewed, applicable credits and exemptions will be restored and any refunds will be issued.

Additionally, several common errors can slow down and hold some ITIN renewal applications. These mistakes generally center on missing information or insufficient supporting documentation, such as name changes. The IRS urges any applicant to check over their form carefully before sending it to the IRS.

As a reminder, the IRS no longer accepts passports that do not have a date of entry into the U.S. as a stand-alone identification document for dependents from a country other than Canada or Mexico, or dependents of U.S. military personnel overseas. The dependent’s passport must have a date of entry stamp, otherwise the following additional documents to prove U.S. residency are required:

- U.S. medical records for dependents under age 6,

- U.S. school records for dependents under age 18, and

- U.S. school records (if a student), rental statements, bank statements or utility bills listing the applicant’s name and U.S. address, if over age 18.

Link to Acceptance Agents - Maryland

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.