Blog - Tax Related

Items filtered by date: December 2021

Medical Expense Deductions

Medical expenses are a financial burden that many of us face any given year. In fact, researchers found that between 2009 and 2020, medical expenses became the number one source of debt owed to collection agencies in the U.S. To help ease the burden, the IRS allows you to deduct most unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI) when filing a Schedule A. If your out-of-pocket medical expenses have consumed more than 7.5% of your AGI, pay attention! The following examples can help you get a clearer picture of what medical expenses you can deduct this tax year.

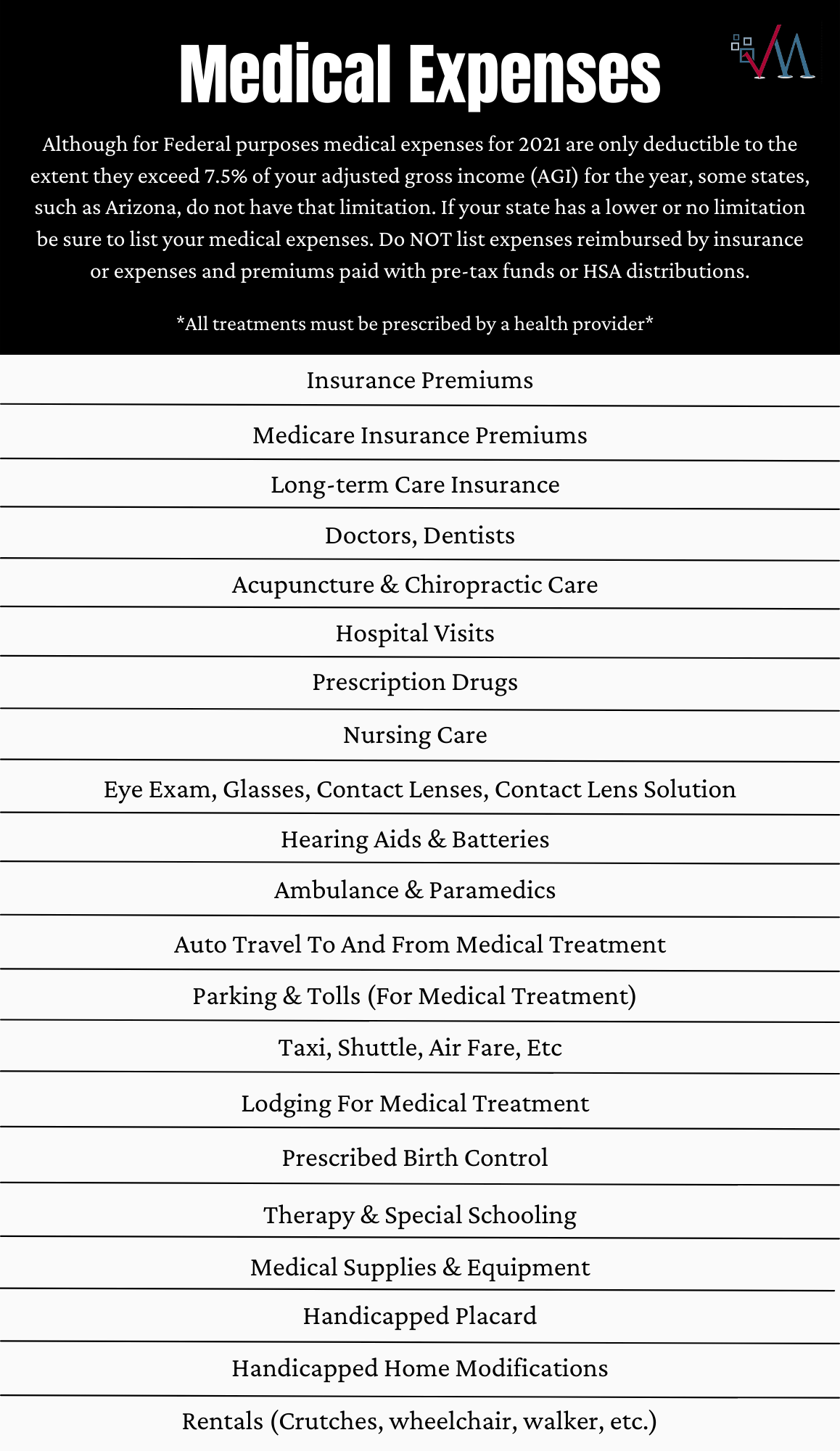

According to the IRS, “medical expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.” This includes fees for doctors, surgeons, dentists, psychologists, and others, in-patient hospital care or residential nursing home care, payments for insulin, false teeth, reading or prescription glasses, hearing aids, and even insurance premiums. The full list of covered medical expenses can be found in the attached image to this post. Although medical expense deductions cover a broad spectrum of medical services, it still has its limitations.

What is, and is not deductible, can be hard to determine. For items that are not covered in this article, refer to this free IRS questionnaire that can help you figure out what you can deduct: https://www.irs.gov/help/ita/can-i-deduct-my-medical-and-dental-expenses For example, the IRS only allows medical deductions if the expenses were paid in the same year as the deduction. You must also reduce your total deductible expenses for the year by any reimbursement of deductible expenses, including medical insurance or if it is paid on behalf of your doctor, hospital, or other medical provider. The agency also notes that you may not deduct for funeral or burial expenses, nonprescription medicines, toiletries, cosmetics, trips or programs for your mental health, or most cosmetic surgeries. Although smoking-cessation programs can potentially be deductible if prescribed by your medical provider, nicotine gum and nicotine patches are not deductible since it is an over the counter treatment, and not medically prescribed by a physician. Generally, if a treatment is prescribed to you by your health provider, it is deductible.

Of course, we are here to help. If you have any additional questions regarding medical deductions, please feel free to leave us a comment on this post or send us an email at This email address is being protected from spambots. You need JavaScript enabled to view it..

Planning on going to GoodWill or Salvation Army to drop off your donations? On our itinerary next week, we will be talking about charitable contributions. This is a popular deduction that can help most of you save this tax season. You don’t want to miss out.

How to Deduct Meals and Entertainment this Tax Year- IRS Notice 2021-25

Figuring out what is tax-deductible can be confusing for businesses. The requirements for meals deductions especially can be subjective, with broad specifications as to what is allowable and what is not. Luckily, in this article, we will be outlining how you and your business can make the most of the recent modifications to meals tax deductions.

The way businesses handle meals and entertainment deductions hasn’t changed much since the 2017 Tax Cuts and the Jobs Act permanently disallowed entertainment write-offs. However, as of 2020, the way businesses can write off meals has changed. In previous years, only 50% of restaurant meals were deductible. Now, meals can be 100% deductible if met by certain, specific requirements. In response to the pandemic, the Consolidated Appropriations Act was signed into law in December 2020 in an effort to temporarily help the struggling restaurant industry.

Now that deducting entertainment expenses is off the table, we should focus on what classifies a meal deduction. The IRS released Notice 2021-25 as guidance. Here is a quick summary of the notice:

- The Notice is effective from Dec. 31, 2020 to January 1, 2023.

- Food and beverages are 100% deductible if purchased from a restaurant within 2021 and 2022.

- Entertainment is no longer deductible under Section 274(a).

As mentioned above, it can be difficult to classify which expenses are deductible. You may have questions such as, “What if I cater food for my business?”, or “What are the limitations to deducting meals?”. According to the notice, no deduction is allowed for the expense of meals unless:

- The expense is not lavish or extravagant under the circumstances; and

- The taxpayer (or an employee of the taxpayer) is present at the furnishing of such food or beverages.

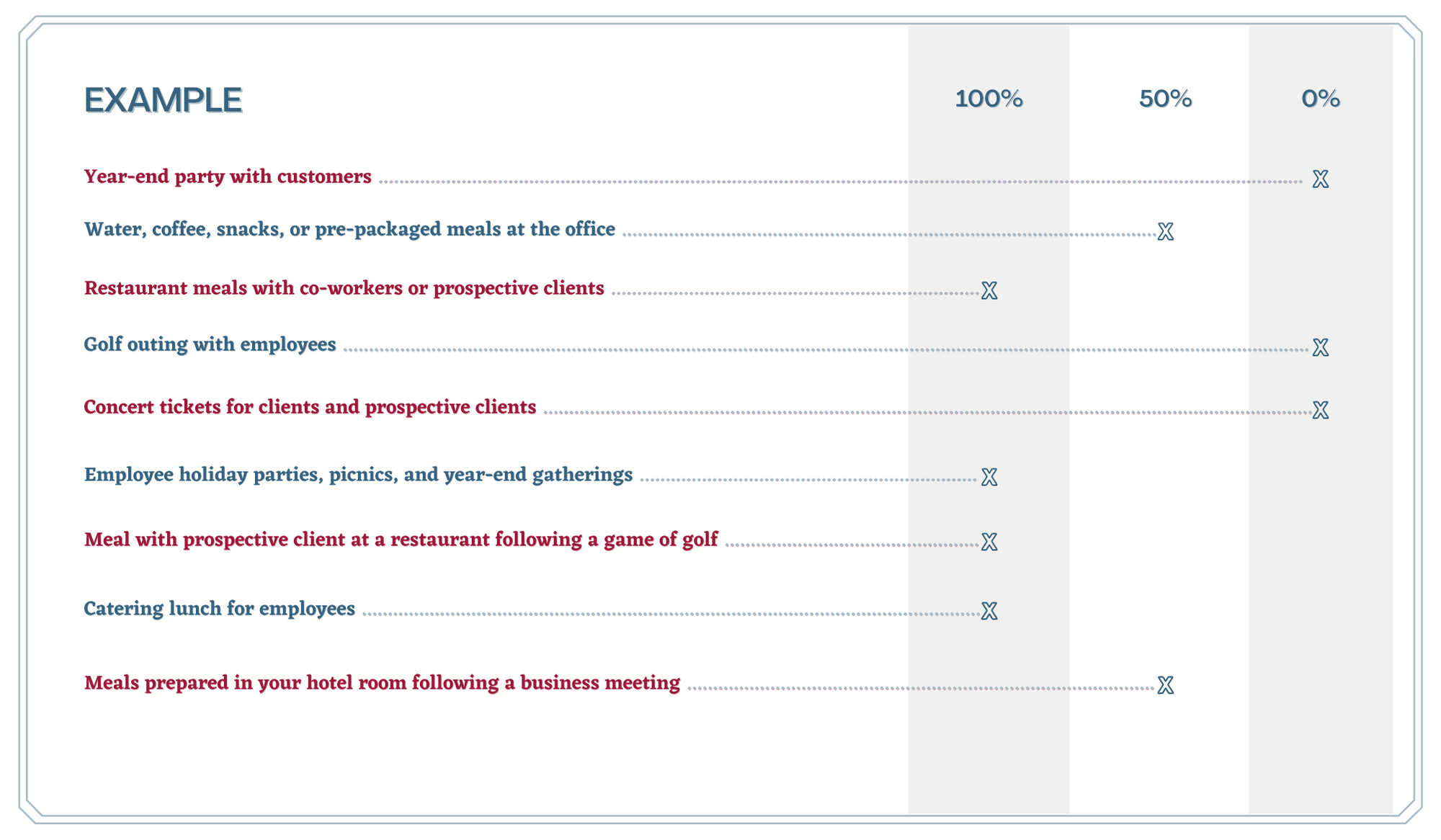

Team building activities, according to the tax code are “expenses for recreational, social, or similar activities (including facilities therefore) primarily for the benefit of employees'. This includes, but is not limited to, holiday parties, annual picnics, company retreats, and summer outings. Activities that are not deductible include sporting event tickets, concert tickets, and golfing, amongst others. Rather, these types of events are categorized as ‘entertainment’ by the IRS. However, it is important to note that food and beverages purchased separately from these ‘entertainment’ activities are still deductible.

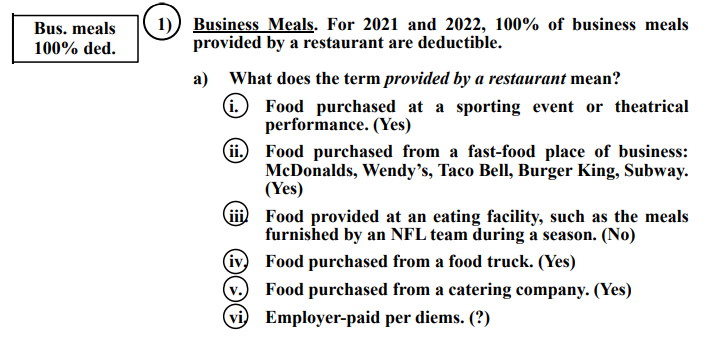

As long as the meals are provided by a restaurant, they are 100% deductible. This also includes catering. The IRS defines "restaurants as a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the businesses’ premises”. Meals that are de minimis fringe benefits, cooked, or prepackaged, are now 50% deductible. That means, if your business provides meals in an in-house cafeteria, or if you prepare a cooked meal in your hotel room while traveling, you are still able to deduct 50%. So if you plan on treating your best client to lunch and a game of golf at the country club, make sure to separate your receipts in order to claim the 100% deduction for your meals.

Making sure you are up to date with your business’s record-keeping is going to be essential in itemizing your meal and entertainment deductibles. It is crucial that you accurately document and record your receipts. If not properly maintained, you may be faced with additional penalties and interest from the IRS in the event of an audit.

We understand that itemizing deductions isn’t always black and white. So, to help you distinguish what is, or is not deductible, we're including a free chart of examples found below. Sometimes, mistakes can happen when using even the best bookkeeping software. Consult your local tax advisor today to take advantage of this new, temporary tax rule.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.