State Filling

Contact info

taxman1

Non-Residence Filing Status

TESTS TO DETERMINE YOUR RESIDENCY

GREEN CARD TEST

You are a resident, for U.S. federal tax purposes, if you are a Lawful Permanent Resident of the United States at any time during the calendar year. This is known as the "green card" test.

You are a Lawful Permanent Resident of the United States, at any time, if you have been given the privilege, according to the immigration laws, of residing permanently in the United States as an immigrant. You generally have this status if the U.S. Citizenship and Immigration Services (USCIS) issued you an alien registration card, Form I-551, also known as a "green card."

You continue to have U.S. resident status, under this test, unless:

- You voluntarily renounce and abandon this status in writing to the USCIS,

- Your immigrant status is administratively terminated by the USCIS, or

- Your immigrant status is judicially terminated by a U.S. federal court.

If you meet the green card test at any time during the calendar year, but do not meet the substantial presence test for that year, your residency starting date is the first day on which you are present in the United States as a Lawful Permanent Resident. However, an alien who has been present in the United States at any time during a calendar year as a Lawful Permanent Resident may choose to be treated as a resident alien for the entire calendar year.

SUBSTANTIAL PRESENCE TEST

You will be considered a U.S. resident for tax purposes if you meet the substantial presence test for the calendar year. To meet this test, you must be physically present in the United States on at least:

1. 31 days during the current year, and

2. 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

Days of Presence in the United States

You are treated as present in the United States on any day you are physically present in the country, at any time during the day. However, there are exceptions to this rule. For details on days excluded from the substantial presence test for other than exempt individuals, refer to Publication 519, US Tax Guide for Aliens.

Resident Alien

An alien who meets either the green card or substantial presence test (described above) is considered a resident alien. However, there are exceptions to the substantial presence test for exempt individuals and for individuals with a “closer connection to a foreign country”.

- Tax return. File Form 1040, 1040A, or 1040EZ. File return with IRS Service Center based on the state of residence.

- Filing status, etc. Filing status, income (generally taxed on worldwide income) under the same rules as a US citizen), adjustments to income, deductions, exemptions, and credits are usually the same as for US Citizens.

Exempt Individuals

For the substantial presence test, days of presence in the US do not count if an individual is temporarily present in the US as a:

Teacher or trainee under a “J” or “Q” visa (certain limits apply)

- Student under an “F”, “J”, “M”, or “Q” visa.

- Professional athlete to compete in a charitable sports event.

- Foreign government-related individual under an “A” or “G” visa.

Filing requirements for exempt individuals. Generally, exempt individuals are considered nonresident aliens and file Form 1040NR. An individual who excludes days of presence under the definition of exempt individual must file Form 8843, Statement for Exempt Individuals and Individuals With A Medical Condition.

Nonresident Alien

An alien is considered a nonresident alien unless either the green card or substantial presence (described above) test is met.

- Tax return. File Form 1040NR or Form 1040NR-EZ.

- The taxpayer is generally taxed only on US source income.

- Filing status. Usually cannot file MFJ. There is a “Treating Nonresident Spouse as Resident” exception.

- Adjustments to income. Generally can claim moving expenses for moves into the US.

- Deductions. Cannot claim the standard deduction and is allowed only limited itemized deductions.

- Exemptions. Generally can claim exemption deduction only to the extent of income that is effectively connected with a US trade or business. Exemptions may not be claimed for dependents except for certain married residents of Canada.

- Credits. Generally, several credits are available, but cannot claim EIC.

Dual Status—Arrival and Departure Year

An individual can be both a resident alien and a nonresident alien during the same year. This dual status usually occurs in the year of arrival into or departure from the US. The taxpayer’s residency status on the last day of the year determines the form to be filed.

Resident at the end of the year:

Resident files a tax return Form 1040 with “Dual-Status Return” across the top showing income from all sources for the residency portion of the year, plus US source income effectively connected with a trade or business from the non-residency portion of the year.

Nonresident at end of the year:

Nonresident taxpayer files a tax return Form 1040NR with “Dual-Status Return” across the top showing US-sourced income for the non-residency portion of the year, plus income from all sources for the residency port of the year.

Restrictions for Dual-Status Taxpayers:

- Standard deduction. Dual-status taxpayers cannot use the standard deduction but can claim any allowable itemized deductions.

- Exemptions. The deduction for exemptions for the taxpayer’s spouse and dependents cannot be more than taxable income for the period as a resident alien.

- Head of household. Dual-status taxpayers cannot claim HOH filing status.

- Joint return. Dual-status taxpayers cannot file a joint return unless a full-year residency election or an election to treat a nonresident spouse as a resident has been made. Thus, married taxpayers must generally file MFS.

TAX IDENTIFICATION NUMBERS

Social Security Number

For US citizens and resident aliens, a valid Social Security Number (SSN) must be used. Persons who require an SSN must file form SS-5 with IRS to obtain a number. (Please note that applicants over 18 years of age applying for an SSN for the first time must attend in person and provide appropriate identification.)

A child born abroad to a U.S. citizen qualifies for United States citizenship even if the child is a resident of a foreign country and if the other parent is not a U.S. citizen. An SSN is required for all children born before December 1996.

Tax Identification Number for Aliens (ITIN)

ITINs are for federal tax reporting only and are not intended to serve any other purpose. IRS issues ITINs to help individuals comply with the U.S. tax laws and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers (SSNs).

An ITIN does not authorize work in the U.S. or provide eligibility for Social Security benefits or the Earned Income Tax Credit.

IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. A non-resident alien individual not eligible for an SSN who is required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty needs an ITIN.

Other examples of individuals who need ITINs include:

- A nonresident alien required to file a U.S. tax return

- A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

- A dependent or spouse of a U.S. citizen/resident alien

- A dependent or spouse of a nonresident alien visa holder

Aliens who are required to have an individual taxpayer identification number (ITIN), but are not eligible to obtain a Social Security number, must file Form W-7, Application for IRS Individual Taxpayer Identification Number.

Taxpayers who are applying for an ITIN to file a tax return must attach original or certified copies, completed return to Form W-7 to get the ITIN. After Form W-7 has been processed, the IRS will assign an ITIN to the return and process the return as if it were filed at the address listed in the tax return instructions.

You may also apply using the services of an IRS-authorized Acceptance Agent or visit some key IRS Taxpayer Assistance Center in lieu of mailing your information to the IRS in Austin. Taxpayer Assistance Centers (TACs) in the United States provide in-person help with ITIN applications on a walk-in or appointment basis.

ITIN’s cannot be used for:

- The ITIN cannot be used to claim the earned income tax credit under section 32 of the Internal Revenue Code;

- The possession of an ITIN does not change the applicant's immigration status or entitle the applicant to legal employment in the United States;

- The ITIN does not take the place of an SSN or qualify the applicant for Social Security benefits;

- If you or your family members obtain permanent resident alien (green card) status or otherwise become legally eligible to work in the United States, you may be eligible for an SSN;

- If any applicant later becomes eligible for an SSN, the ITIN may no longer be used, and an SSN must be obtained from the Social Security Administration;

ITIN Policy Change Summary for 2013

Changes impacting individuals applying for an ITIN

The information below highlights improvements to the ITIN program. They go into effect on January 1, 2013.

“If you are applying directly to the IRS for an ITIN, we will only accept original identification documents or certified copies of these documents from the issuing agency along with a completed Form W-7 and Federal tax return”.

In order to file your application, you will need to prove your claims of alien status and identity. The following copies of documents certified by the issuer are required for this purpose:

1) Passport or INS document establishing the non-U.S. status and residence of the applicant; or

2 )Foreign birth record and one of the following, which must bear a photograph, has not expired, and is not older than three years:

- Drivers license;

- Identity Card;

- Voters Registration Card;

- School records;

- Medical Records;

- Marriage record;

- Military registration card; and

3) If the applicant is residing in the United States, please provide the U.S. visa or other proof of ineligibility for an SSN.

Allow 6 weeks for the IRS to notify you of your new ITIN on Form 9844 (8 to 10 weeks if you submit documents. If you have not received your ITIN or correspondence at the end of that time, you can call the IRS to find out the status of your application.

Have you withdrawn a portion of your retirement funds early because of the pandemic and are now stuck with paying the 10% early withdrawal penalty? Many people have found themselves in financial hardship and have needed to take out some of their retirement funds before the mandated retirement age. Normally, early distributions made prior to turning 59.5 years of age have been subject to penalties and income tax. However, in light of the pandemic, the IRS has recently released some guidance regarding early withdrawals.

In the recent publishing of IRS Notice 2020-50, the IRS addressed coronavirus-related distributions within the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Here is the basic rundown of the benefits:

|

To qualify for assistance, the IRS requires an ‘acceptable self-certification’:

|

|

Learn how we turned Martha’s $22,000 tax liability into a tax refund:

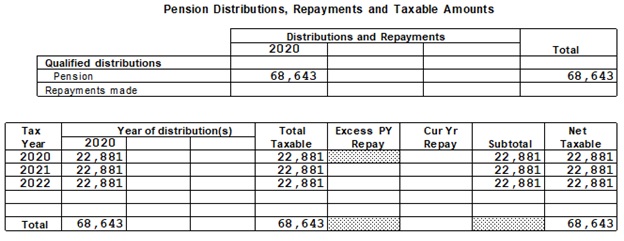

Martha came to us after she withdrew $68,643 from her pension plan. Since she distributed her funds before the mandated retirement age, she accrued $6,864 in penalties. On top of the penalties, there are also federal and state taxes, adding $16,000 to her overall bill. Before Martha came to us, she owed $22,864 in taxes and penalties.

Her husband's furlough from his job last August qualified the couple for relief. After consulting Alejandro, our EA and tax advisor, she was able to abate the $6,864 penalty entirely and split her withdrawal into three separate, taxable distributions. For the years 2020, 2021, and 2022, she will recognize $22,881 from her retirement plan. This way, Martha can meet her family's needs while paying only a fraction of what she owed in taxes. In the end, reducing her taxable income resulted in Martha receiving a tax refund for the 2020 tax year. Thanks to Alejandro, Martha went from being tens of thousands of dollars in debt to the IRS to have the IRS owe her money back during a time of need.

If Martha's story sounds familiar to you, don't let this opportunity pass by. Schedule an appointment at Mendoza&Co today to see how we can work for your tax needs.

TAXPAYER BILL OF RIGHTS

Download a copy of the Taxpayer Bill of Rights (en español.)

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.