Attention all S corporation shareholder-employees: be aware of upcoming IRS audits! If you own and perform business under an S corporation, you may already know to compensate yourself as an employee. Failing to provide yourself with compensation or providing too little compensation can get you into a problematic audit with the IRS. With IRS operations slowly going back to normal, expect an increase in audits.

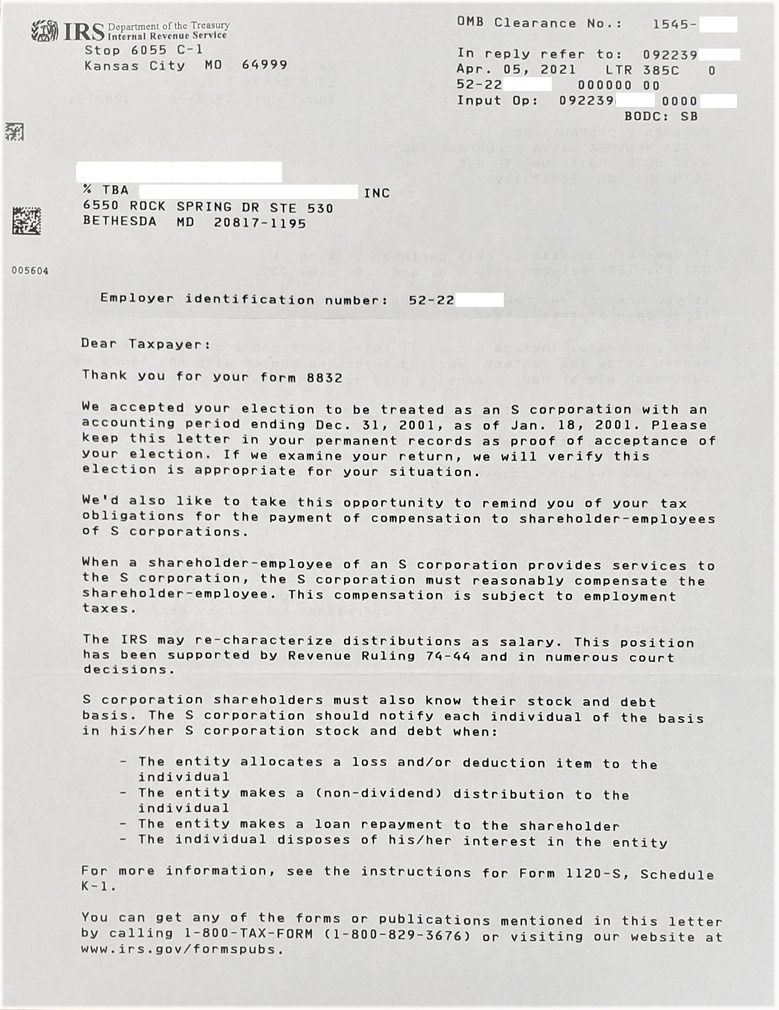

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

It can be difficult to determine what a reasonable salary is, so let’s tie everything together with a simple example:

Joe owns a plumbing company. He has eight employees, all under W2’s, and he pays them about $600,000 as a part of payroll. He also pays himself a ‘reasonable’ salary of $65,000, which is approximately the average salary for a plumber in his area.

He pays his employees and collects payroll taxes from them, relaying the tax amount to the government. Joe is in compliance. In the event of an audit, he is in good shape.

Mike, too, owns a plumbing company in the same state as Joe. He also has eight workers, but he classifies them under 1099-NEC even though they all work for him 40 hours a week and depend on him financially. According to the IRS, these are not workers; they are employees. Employees are paid under W2’s, similar to Joe’s employees. On top of that, Mike doesn’t pay himself a salary but instead withdraws the business’ profits into his account. He is not paying the payroll taxes from all workers, including Mike’s withdraw. Mike was sent the same friendly reminder but decided to take his chances and ignore the letter. A year later, the IRS knocks on his door and audits his plumbing business.

The IRS audit causes a ripple effect. His 2018 tax year gets audited, then the 2017 year, and the 2016, and the 2015 tax year. Mike gets audited for six years, and as a result, the IRS also reclassifies the workers as employees. The next thing he knows, his business owes $750,000, and he personally owes $480,000 in payroll taxes to the IRS. Mike will need to reclassify all of his employees and pay off his debt. If he can’t afford to pay off his personal debt, the IRS will threaten to levy his personal assets.

Luckily, Mike should not lose hope. Here at MendozaCo, we handle these kinds of situations often. The key in Mike’s scenario, like most scenarios with the IRS, is that he needs to get into compliance. Without compliance, negotiating with the IRS is near impossible, and penalties will continue to accrue. If Mike’s situation sounds similar to yours, please don’t hesitate to call us. We can take care of your IRS tax problems, as well as keep you in compliance by managing your payroll for you.